There is an episode of Grey’s Anatomy where the doctors go to deliver the baby of a violent inmate who has been kept in isolation for a long time. It is a very touching episode because it speaks on the subject of human connections. Laying hands on another person is a powerful gesture – both when violent and when caring.

We fight and batter each other, we dominate and submit, we wrangle and wrestle with each other and the vagaries of life. We comfort each other, cuddle and caress each other; we tell each other that we are in this together, however tough.

We touch each other.

Touching others gives us hope, comfort, meaning.

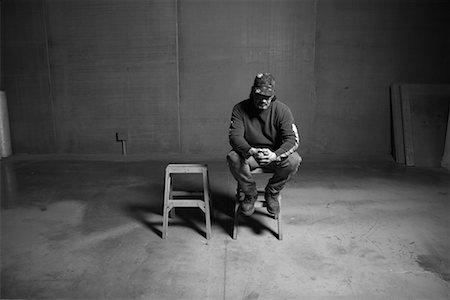

Because the opposite, isolation, disintegration, abandonment, and dissolution are awful. Loneliness is a killer.

The United States Centers for Disease Control say that social isolation significantly increased a person’s risk of premature death from all causes, a risk that may rival those of smoking, obesity, and physical inactivity. Isolation carries an increased risk of dementia, heart disease, and stroke, depression, anxiety, and suicide.

Now take a step back and look at our post-COVID, crypto #blockchain #DeFi #metaverse world.

Sitting in your room reading through Twitter posts, trading your memecoins and perps, putting on your VR goggles, and ensconcing your tired self in endless computer games and alternate realities — you may not feel isolated because you have technology and avatars, disembodied personae, and ephemeral digital constructs to talk to. (I know a guy who calls his bored ape his “pet” and talks to him as if it were a real simian.)

But take that away, and what’s left is you, alone, sitting in an empty room.

Pascal famously said

“All of humanity’s problems stem from man’s inability to sit quietly in a room alone.”

We are talking to machines now, we are playing #games with #avatars, we hold conferences in the metaverse, and spend endless hours in Google Meets and Zooms.

The way we communicate, congregate, copulate, and consummate is increasingly troubling, and perhaps responsible for the rise in many a disease and mental issue. I am a lonely person. And yet I don’t feel lonely most of the time, because of technology. But at the end of the day, despite our technological prowess and artificial perorations, we are still stuck in those eons-old biological cages we call the human body. A body used to dirt and dust, sand and soil, and wood and water and wind.

A body that wants to touch things and yearns to be touched.

Most of the #crypto degens out there, the under-30 fucktards who trade Shiba Inu at 200x, buy anything that moves regardless of fundamentals, bitch on Twitter and fight like teenage delingquents on Discord and Telegram, smoke another joint, then play Call of Duty (we call it COD. “Like the fish?” No you moron. C.O.D.), or hang out with overly sexualized Japanese cartoon school girls in VRChat — those guys may not realize it yet, but that body decays rather too quickly and becomes not a delight but a burden. And once the wild years of profligate penetrations are over, you may find yourself alone in that very same room, still stuck in some mediocre unimaginative metaverse that ostensibly gives you human contact, but really only pushes you down the slippery slope of decrepitude and depression and charges you an arm and a leg for the privilege of feeling alone.

Too gloomy? Awwwwright. Cheerier thoughts then.

Communication is so much more than language. I spend countless hours each week on zoom calls with colleagues and clients around the world. So much so, that over the winter I didn’t get out much and put on a stone of blubber.

In the jovial month of Jun, however, I was in Barcelona to teach and network, in Braga to touch base with the global Uphold crew, and in New York to titillate clients and have steak with Uphold Institutional core team. (Hit me up for restaurant tips, I know the best steak in Manhattan)

For teaching: in a classroom, you get so much more feedback, and your words have so much more impact when standing in front of real students with actual bodies rather than just faces on a screen. Learning in a physical human setting is as if wisdom and curiosity were particles floating through the air, cartwheeling between engaged minds, rather than stale words read off a dim screen into the void of disinterest.

For meeting the team: OMG. We in tech, we nerds and crypto crazies, we’ve gotten used globe-spanning collaborations and intense cooperation with colleagues we’ve never even met. We make projects work that span the globe, whilst sitting at home in solitary confinement. Put us in a room, (a posh hotel conference room at that), watch them perambulating, some shy, some confidently, presenting their departments’ previous achievement and planned performances, and you learn so much more about the state of the company, its direction and decisions, the business’ risks and rewards (hash tag long term goals hash tag low-hanging fruit), and you get to love and cherish the genius of the folks at Uphold. (It is a company of massive brain power I can tell you.)

And as for client interactions (my colleague MJ’s favorite KPI!: I do dozens of client calls a month, talk about my opinions, explain my thinking, and answer their questions, and it is fruitful and all, no worries. Yet … sitting in a corner conference room on the 46th floor, overlooking Manhattan and the Hudson River, a helicopter flying by so closely you can see the occupants, feeling slightly dizzy with vertigo while drinking Perrier and talking zkproofs, artificial intelligence, and the future of Casper, Kaspa and Cardano, that is a whole new ballgame. Instead of a simple Q&A, a scipted back-and-forth, you enter in real life debate, an exchange, a discourse; you bounce questions and ideas off each other, and you leave the meeting with, not a sense of “meeting over,” but more like “gosh I love this guy, he’s really smart” or, occasionally, with “what a prick!”

What it comes down to is body language.

The language spoken by those nimble limbs! The language you don’t see on Zoom where all too often cameras even, those last lost opportunities of gauging reactions, are turned off. Don’t be shy. Everyone’s ugly on Zoom. The beautiful people moved to Instagram.

Communication is more than speech

Communication between humans is so much more than a voice spoken or a video watched. It’s about the whole in-bloody-real-fucking-life experience. The nods, the head shakes, the glimmer in the eyes, the bored yawn or look at the watch, the neck twisting, the stretching, the sipping from the cup at the right moment, the sudden “aha” you see on their eyebrows or the “nah, that’s not right” expressed only in a frown.

All that has been taken away by iPhones and Covid, and we won’t get it back any time soon.

Next iteration of humanity

We are raising a new generation of humans who grow up, work and play, live and love in isolation. We are transforming, from the ground up, what it means to be human. We (in the tech industry, in rich countries, at least) no longer toil in the fields or hunt the wild boar. We don’t sit round the campfire in the middle of bumfucknowhere (as my Midwestern colleague taught me it is so lecherously referred to out in the sticks). We don’t use those muscles that carry us up the mountain or down the ravine, build farmsteads and cut down trees. We have only brains and merely artificial gym-grown brawn. We have removed ourselves from the very environment that shaped our human form.

Instead, we get strong hand muscles from typing, our eyesight changes, and our brains start to work differently. Studies show that prolonged use of lit screens leads to a drying out of the eye, then eye strain, then permanent ailments and long-time sight problems. They have also shown, in MRIs, that the brains of children who play mostly outdoors and those who spend the majority of their time in front of the computer, light up differently when completing tasks.

The human race is forking like a bloody blockchain.

This is not necessarily the end of humanity. Perhaps the classic image of a pale grey alien with a large head and big eyes is a glimpse of our true future, not an alien race from outer space. We have always adapted somehow.

But I wonder.

The changes have never been more dramatic, never faster than they are now. The singularity Ray foresaw is certainly already here. Are we splitting up into two different races? The homo technicus with different faculties, different bodies, and different minds from the homo drudgicus who is stuck with manual labor and an active outdoor life? Is this too part of the technology gap? Generation gap, wealth gap, gender gap .. humanity is mostly made out of gaps, isn’t it? We’ve never really cared much about filling in the gaps.

Most of all, I am worried about the social skills of the next generation, raised with much less human touch, much less of the “laying on hands” mentioned in the Grey’s Anatomy episode. Are we so belligerent on social media because we don’t see the other person’s body language? We will soon spend more time speaking to AIs than to our neighbors — will that make it even worse?

Anyway. Enough waffle. I bought a bike recently, on the interweb, proudly assembled it myself, and now I’m off for a ride in the countryside. Without phone, iWatch, e-wallet, keys, nothing. No CBDC either, just two good old silver coins in case I need … well .. actually, I don’t even need those. Just me, in white cotton (honestly, fuck Lycra, nobody looks good in that), my flabby old self, my thoughts, my reflections, and a blue bicycle that may be a size too small. (Note to self: buy less shit on the Internet). I’ll probably suffer a stroke from gadget withdrawal syndrome. Or have an accident in a cornfield and die in a ditch.

Or I’ll find a less techy me, a less connected me, a new me, or rather an old me, but, really, definitely, another me.